straight life policy term

However both insureds must die before a death benefit is paid - in other words only after the death of the. Unlike term life insurance.

If X wants to buy 50000 worth of permanent protection on hisher spouse and 25000 worth of 10-year.

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

. The face value of the policy is paid to the insured at age 100. A type of life insurance with a limited coverage period. Insurance on the life of the.

But whole life policies combine both a death benefit and a savings feature. Credit Life insurance is. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242.

Because whole life insurance offers permanent coverage or coverage during the policyholders entire life the premium is. It is also known as ordinary life insurance. Straight life insurance is.

Issued in an amount not to exceed the amount of the loan. The goal of a permanent policy is to have life insurance in place for the rest of your life. An advantage in getting term insurance is.

If you have a short-term life insurance need term life. Term Ticket Model. STRAIGHT LIFE INSURANCE noun The noun STRAIGHT LIFE INSURANCE has 1 sense.

It is meant for long-term goals and not short-term needs. Straight life insurance is a type of permanent life insurance. It usually develops cash value by the end of the third policy year.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Get a Free Quote on the Right Insurance Policy for Your Needs. In the Distribution world Straight Through Processing was defined as a Drop-Ticket or Term-Ticket during its peak years from 2011-2016running a term.

Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death. Credit Life insurance is. With term insurance a death benefit is a primary feature.

For example the average cost of a 20-year 100000 term life insurance. It has the lowest annual premium of the three types of. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or.

If you think you may want the benefits and growth of a straight life policy but are concerned about premium costs a convertible term policy might be right for you. Term Life Insurance. Insuranceopedia Explains Whole Life Insurance.

Ad Put You and Your Loved Ones on a Path Toward Financial Preparedness for the Future. Straight life policies are often expensive and therefore not recommended for short-term life insurance coverage. Straight life insurance can be used as a financial planning tool.

A life insurance policy that provides coverage only for a certain period of time. As with all whole life. A type of life insurance contract that provides for insurance coverage of the contract holder for hisher entire life.

Traditional Whole Life Policy. If X wants to buy 50000 worth of permanent protection on hisher spouse and 25000 worth of 10-year. February 27 2022.

Protect Your Loved Ones. It can be increased or decreased as the policyholder chooses so long as there is enough value in the policy to fund the death benefit. Term life insurance covers you for a specific number of years usually 10 20 or 30 years while whole life insurance covers you for life as long as you keep up with your.

A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Straight Life An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life.

What does straight life insurance mean. After death however the payments cease and the. Issued in an amount not to exceed the amount of the loan.

Which of the following is an example of a limited-pay life. A whole life policy in which premiums are payable as long as the insured lives. Once that period or term is up it is up to the policy owner to decide whether to renew or to let the.

Survivorship life insurance differs in that it is a policy that is written on two lives. International Risk Management Institute Inc.

How Does Life Insurance Work The Process Overview

Joint And Survivor Annuity The Benefits And Disadvantages

Life Insurance Wikipedia The Free Encyclopedia Life Insurance Quotes Life Insurance Policy Insurance Quotes

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

How Return Of Premium Life Insurance Works Nerdwallet

Period Certain Annuity What It Is Benefits And Drawbacks

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

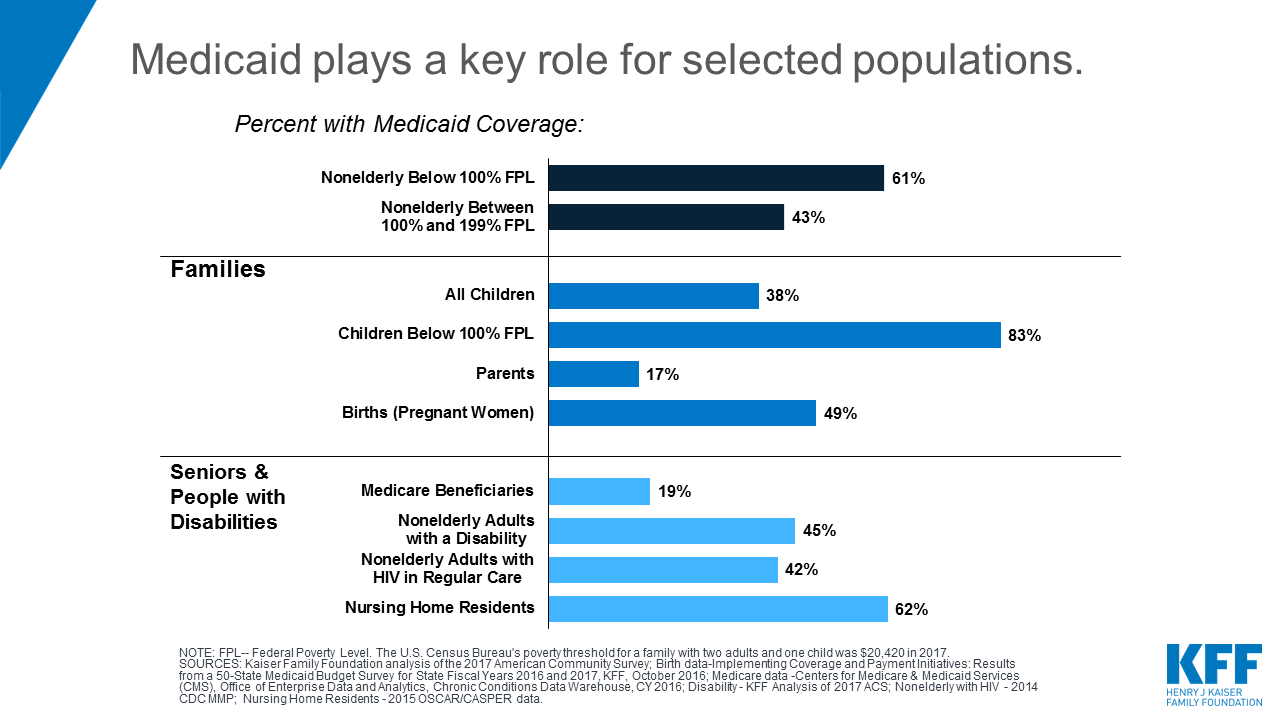

10 Things To Know About Medicaid Setting The Facts Straight Kff

Whole Life Insurance Definition

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Line Depreciation Formula Guide To Calculate Depreciation

Annuity Payout Options Immediate Vs Deferred Annuities

Straight Line Depreciation Formula Guide To Calculate Depreciation

What Is Whole Life Insurance Cost Types Faqs

Super Straight Meaning Trolls Started Transphobic Social Campaign

/What-is-heteronormativity-5191883-FINAL-0c8f5100dbe04694a6fe1fbba052748f.png)